News Releases

Rise Gold Announces Delay in Trial Schedule

(Show News Item)

January 9, 2026 – Grass Valley, California – In its September 16, 2025 press release, Rise Gold Corp. (CSE: RISE, OTCQB: RYES) (the “Company”) announced that Nevada County (the “County”), Rise, and the Superior Court of California for the County of Nevada (the “Court”) agreed to a schedule that anticipated that oral arguments concerning Rise’s Writ of Mandamus (the “Writ”) would be held on January 9, 2026. On January 8, the Court on its own initiative delayed the oral arguments until March 6, 2026.

The Company submitted the Writ on May 13, 2024, asking the Court to compel the Board of Supervisors of Nevada County (the “Board”) to follow applicable law and grant Rise recognition of its vested right to operate the Idaho-Maryland Mine (the “I-M Mine”). The I-M Mine produced 2.4 million ounces of gold at an average mill head grade of 0.50 ounces per ton and was in production before, during, and after the County adopted its zoning code, which established a vested right for the I-M Mine to operate without a permit. On December 14, 2023, the Board rejected the Company’s vested rights petition because “all mining activities at both the Brunswick and Centennial cites [sic] had ceased by 1956.” The County ignored the California Supreme Court’s 1996 ruling in the Hanson Brothers case that “cessation of use alone does not constitute abandonment” of a vested right, but rather that the County must show by clear and convincing evidence “an intention to abandon” the right to mine.

Rise filed its initial brief in support of the Writ on September 6, 2025. The County replied on November 18, 2025, arguing: “A vested right protects only an existing, lawful use that continues in operation, not one that ceased nearly seventy years ago.” Rise replied on December 5, 2025, pointing out that “in just the last six years, California counties have applied Hansen Brothers at least four times in public hearings to recognize a vested right to mine at a property where mining had ceased for periods ranging from 53 to 75 years” and listed the four cases.

On December 17, the County filed a brief demanding that the Court ignore the four cases because they “were never provided to the Board” and because “new evidence is not permitted with reply papers.” The County demanded the Court either ignore the citations or delay the January 9 hearing to give the County time to respond to Rise’s reply.

On December 23, Rise explained to the Court that Rise is “not offering these decisions as factual evidence but as persuasive legal authorities, and the Court may take judicial notice of them because they are authentic documents memorializing government acts,” that Rise “offered these authorities directly in response to arguments Respondents made in their Opposition,” and that Rise “did cite three of the four decisions to the County in the proceedings below,” while the “fourth vested-right determination post-dated the proceedings below and so could not have been cited there.” Rise pointed out that the County’s brief “is an obvious attempt to delay this case, which has already been pending for more than a year and a half despite the closed record and lack of discovery.”

The Court announced the delay in the late afternoon the day before the hearing and gave no reason for its action.

David Watkinson, CEO of Rise Gold, commented: “We are frustrated that the Court chose to delay resolution of the Writ. However, we recognize that the administrative record supporting the Writ is voluminous and that this case has broad implications for property rights in the whole state of California.”

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

For further information, please contact:

RISE GOLD CORP.

345 Crown Point Circle, Suite 600

Grass Valley, CA 95945

T: 530.271.0679 Ext. 101

dwatkinson@risegoldcorp.com

www.risegoldcorp.com

Rise Gold Appoints David Watkinson as President and CEO

(Show News Item)

November 20, 2025 – Grass Valley, California – Rise Gold Corp. (CSE: RISE, OTCQB: RYES) (the “Company” or “Rise Gold”) is pleased to report that Mr. David Watkinson has been appointed as President and CEO of Rise Gold and President of the Company's wholly owned operating subsidiary, Rise Grass Valley Inc. Mr. Watkinson has also been appointed as a Director of the Company. In addition, Rise Gold announces the results of its Annual General Meeting held on November 19, 2025. All resolutions were passed, including the re-appointment of Davidson & Company LLP, Chartered Professional Accountants, as auditor until the next annual meeting, and approval of the Corporation’s long-term incentive plan. Daniel Oliver was appointed Chairman of the Board.

Mr. Watkinson brings forty years of professional engineering experience in underground and open pit mine development and has held senior positions with Placer Dome Inc., Kinross Gold Corporation, Thyssen Mining Construction of Canada, and Vulcan Materials Company. He was also the President and CEO of Emgold Mining Corporation, which controlled Rise’s wholly-owned Idaho-Maryland mine (the “I-M Mine”) for approximately 25 years preceding Rise’s purchase of the property.

Dan Oliver, Chairman of the Board of Rise Gold, commented: “Mr. Watkinson brings decades of technical knowledge about the I-M Mine and has kept an office in Nevada County (the “County”) for approximately 20 years, making him known and respected in the local community. The board of directors is confident that Watkinson’s leadership will help unlock the value of the I-M Mine.”

The I-M Mine operated nearly-continuously from 1862 to 1957, producing an estimated 2.4 million ounces of gold at an average mill head grade of 0.50 ounces per ton (17.1 grams per tonne). From December 1955 through 1957, the mine produced tungsten with financial support from the Department of Defense. In 2024, the Company filed a writ of mandamus against Nevada County after County’s supervisors failed to recognize Rise’s constitutionally-protected vested right to operate the I-M Mine. The Company expects a verdict on the writ in the first quarter of 2026.

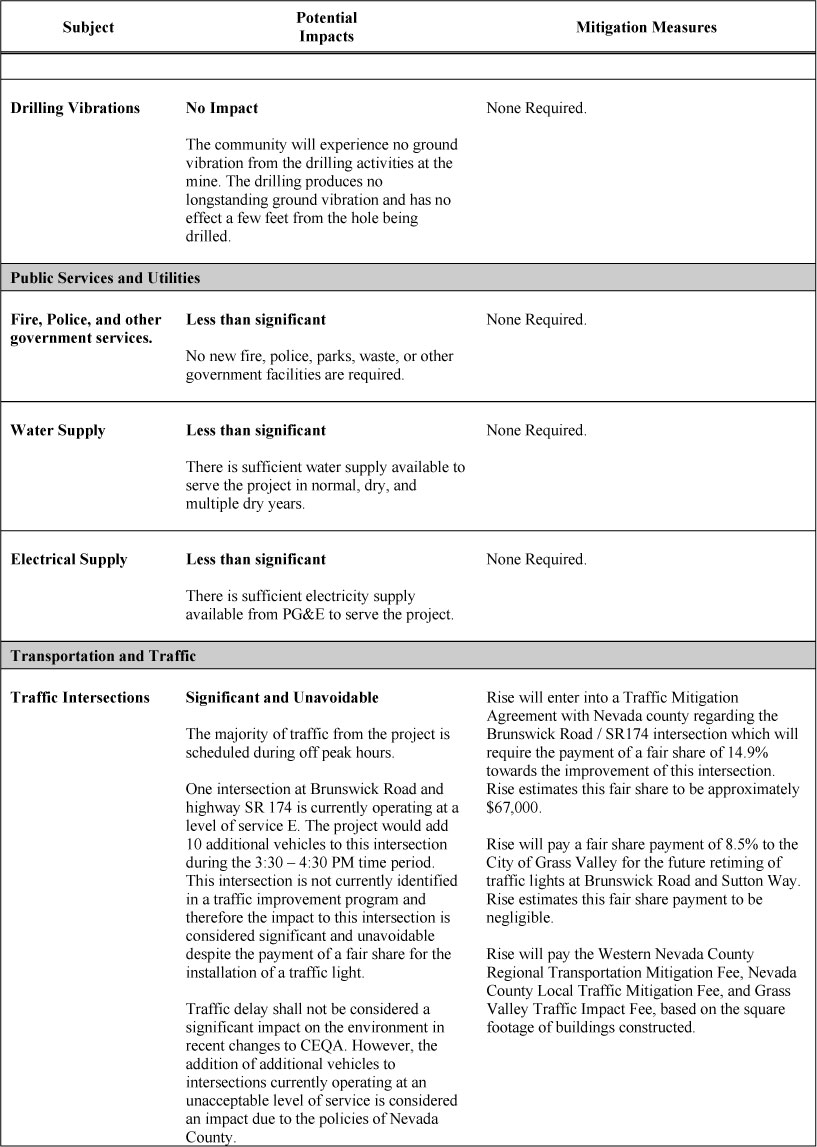

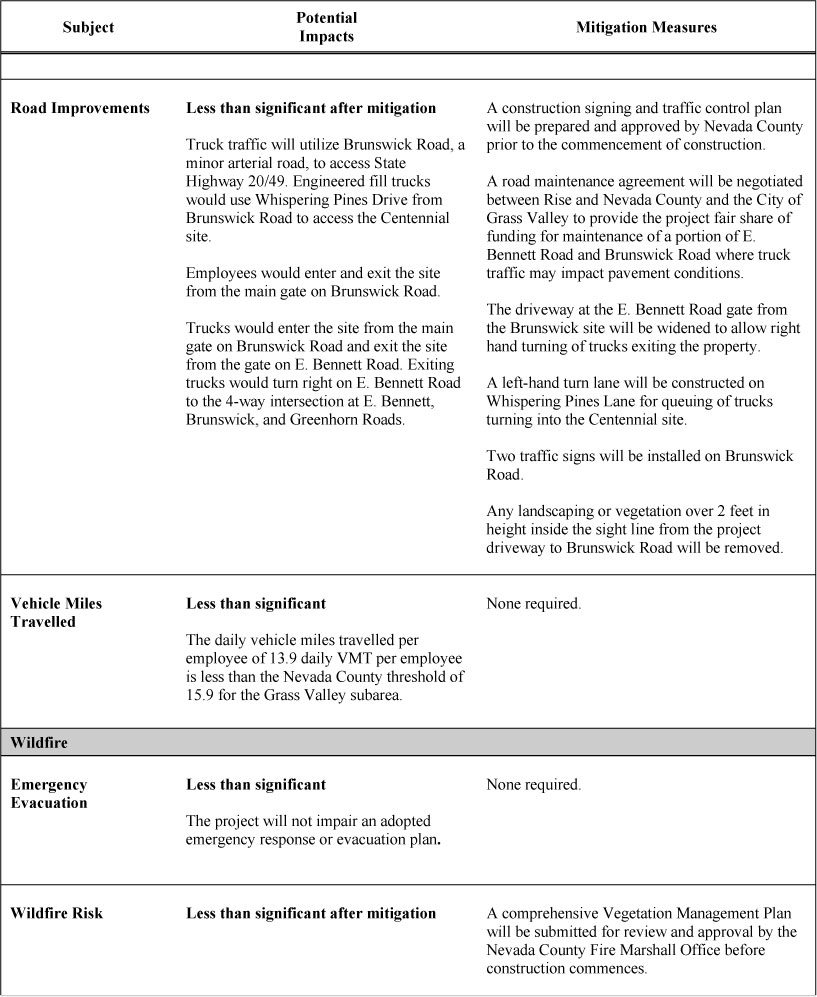

The Company further reports that Mr. Joe Mullin has resigned from the Board of Directors and as President and Chief Executive Officer, effective November 20, 2025, in order to pursue a new opportunity. Oliver commented: “Mr. Mullin joined the Company at a particularly challenging time, as the County was denying approval of the County’s own 40,000-page Environmental Impact Report that reported only three significant impacts from the I-M Mining project: temporary construction noise, traffic at a single interaction already operating above capacity, and visual changes at the project site. He leaves the Company with a full treasury and a legal team committed to resisting the County’s attempts to convert Rise’s property for public use without compensation. The board of directors extends their appreciation to Joe for his efforts and wishes him success in his future endeavours.”

The Company also announces that it has granted a total of 2,660,000 stock options to directors, officers, and consultants of the Company pursuant to the terms of the Company's Long Term Incentive Plan dated October 17, 2025. The stock options are exercisable at a price of US$0.18 per share until November 20, 2030.

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

On behalf of the Board of Directors:

Daniel Oliver Jr.

Chairman

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

345 Crown Point Circle, Suite 600

Grass Valley, CA 95945

T: 530.433.0188

dwatkinson@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words or statements that certain events or conditions “may” or “will” occur.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks, uncertainties and assumptions related to certain factors including, without limitation, obtaining all necessary approvals, meeting expenditure and financing requirements, compliance with environmental regulations, title matters, operating hazards, metal prices, political and economic factors, competitive factors, general economic conditions, relationships with vendors and strategic partners, governmental regulation and supervision, seasonality, technological change, industry practices, and one-time events that may cause actual results, performance or developments to differ materially from those contained in the forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements and information contained in this release. Rise Gold undertakes no obligation to update forward-looking statements or information except as required by law.

Rise Gold Commences Review of its Tungsten Exploration Targets At the Idaho-Maryland Mine, CA

(Show News Item)

November 4, 2025 – Grass Valley, California – Rise Gold Corp. (CSE: RISE, OTCQB: RYES) (the “Company”) announces it has commenced a review of historical data indicating that the Company’s wholly-owned Idaho-Maryland mine (the “I-M Mine”) may contain significant amounts of tungsten, a metal listed in the U.S. Department of Energy’s 2023 DOE Critical Metals List.

The I-M Mine operated nearly-continuously from 1862 to 1957, producing an estimated 2.4 million ounces of gold at an average mill head grade of 0.50 ounces per ton (17.1 grams per tonne). By the early 1940s, the I-M Mine was the second-largest gold producer in the United States. Following World War II, the Bretton Woods monetary agreement fixed the gold price at $35/oz while inflation sent production costs higher, making gold mining unprofitable.

In 1954, the operator of the I-M Mine began exploring for tungsten under a program sponsored by the U.S. Department of Defense. Sufficient tungsten was discovered such that the company modified one of its mills to extract tungsten from the calcium tungstate mineral, scheelite, to produce a tungsten trioxide concentrate. By December 1955, all mining and milling of gold was discontinued, and operations focused solely on the production of tungsten. A report that year noted that the tungsten-rich veins continued at depth and recommended “an intensification of tungsten prospecting and research which should greatly prolong the tungsten producing period.”1

In 1957, the price of tungsten fell by more than half, Congress discontinued the defense minerals program, the operator of the I-M Mine lacked the capital to continue development of the tungsten resources, and operations at the mine were suspended. The company sold equipment and various non-core surface parcels to pay down debt in order to preserve its ownership of the mineral estate. The mineral estate and the core surface properties were held intact by various successive owners and was acquired by Rise in 2017.

The Energy Act of 2020 began a process to define critical minerals important to the United States. The 2023 DOE Critical Metals List includes tungsten, a necessary component in a wide array of defense applications, including but not limited to the production of ammunition, armored equipment, and artillery. The United States has not had a domestic supply of tungsten since 2015. China currently produces 84% of the global tungsten supply and in February 2025 announced restrictions on tungsten exports.

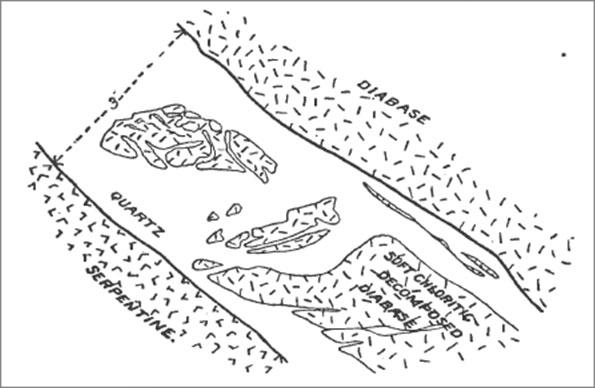

Joe Mullin, CEO of Rise Gold, commented: “The mining property’s long association with

tungsten, described in local newspaper articles since 1912, is the reason the U.S. Defense

Department selected the I-M Mine for tungsten exploration and development following the Korean

War. Rise Gold’s mining property includes the historic Brunswick and Union Hill mines, where

tungsten deposits were identified and exploited. Exploration and mineral development occurred in

the Brunswick 19, 45, and 46 veins. A 1955 report2 to the Bureau of Mines indicated 3,086 short

tons of tungsten ore were mined at an average mill grade of 1.30% WO3 and a 1956 report indicates

5,8983 short tons of tungsten ore were mined at an average mill grade of 0.83% W03. Concentrates

were produced in excess of 70% WO3.”

Mullin continued: “Tungsten was already classified as a critical mineral by the federal government,

and a March 2025 executive order expanded the list to include gold, making the I-M Mine an ideal

project for federal sponsorship as the United State reshores its critical defense industries.”

The Company has retained the services of David Watkinson, P.Eng. and Robert Pease, C.P.G. to

perform an initial review of the historic materials relating to tungsten and to generate work

recommendations, which may include re-assaying existing drill cores and pulps. Watkinson was

the President and CEO and Pease was the Chief Geologist for Emgold Mining Corporation, which

controlled the I-M Mine for the approximately 25 years preceding’s Rise’s purchase of the

property.

Qualified Person

All scientific and technical information disclosed in this new release was reviewed and approved

by David Watkinson, P.Eng., a consultant to Rise Gold and an independent qualified person under

National Instrument 43-101

Footnotes

1. Beechel, G.R., Geologic Report on the Tungsten Exploration of the Brunswick Mine, October 14, 1955

2. Report to United States Department of Interior, Bureau of Mines, Tungsten Ore in Concentrate, 1955

3. Report to United States Department of Interior, Bureau of Mines, Tungsten Ore in Concentrate, 1955

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s

principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada

County, California, USA.

On behalf of the Board of Directors:

Joseph Mullin

President and CEO

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

345 Crown Point Circle, Suite 600

Grass Valley, CA 95945

T: 917.349.0060

jmullin@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of applicable

securities laws. Forward-looking statements are frequently characterized by words such as “plan”,

“expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words or

statements that certain events or conditions “may” or “will” occur.

Although the Company believes that the expectations reflected in the forward-looking statements

are reasonable, there can be no assurance that such expectations will prove to be correct. Such

forward-looking statements are subject to risks, uncertainties and assumptions related to certain

factors including, without limitation, obtaining all necessary approvals, meeting expenditure and

financing requirements, compliance with environmental regulations, title matters, operating

hazards, metal prices, political and economic factors, competitive factors, general economic

conditions, relationships with vendors and strategic partners, governmental regulation and

supervision, seasonality, technological change, industry practices, and one-time events that may

cause actual results, performance or developments to differ materially from those contained in the

forward-looking statements. Accordingly, readers should not place undue reliance on forwardlooking

statements and information contained in this release. Rise undertakes no obligation to

update forward-looking statements or information except as required by law.

Rise Gold Grants Stock Options and DSUs

(Show News Item)

October 30, 2025 – Grass Valley, California – Rise Gold Corp. (CSE: RISE, OTCQB: RYES) (the “Company” or “Rise Gold”) announces that it has granted a total of 1,445,469 stock options to directors, officers, and consultants of the Company pursuant to the terms of the Company’s Long Term Incentive Plan dated October 17, 2025 (the “Plan”). The stock options are exercisable at a price of US$0.25 (CAD$0.35) per share until October 30, 2030.

The Company also announces that it has granted an aggregate of 1,365,854 deferred share units of the Company (the “DSUs”) to certain directors and officers the Company pursuant to the terms of the Plan. Each DSU entitles the holder to receive one Common Share upon cessation of being an Eligible Person as defined under the Plan.

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

On behalf of the Board of Directors:

Joseph Mullin

President and CEO

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

345 Crown Point Circle, Suite 600

Grass Valley, CA 95945

T: 917.349.0060

jmullin@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Rise Gold Closes US$7,000,000 Financing

(Show News Item)

October 24, 2025 – Grass Valley, California – Rise Gold Corp. (CSE: RISE, OTCQB: RYES) (the

“Company” or “Rise”) is pleased to announce that it has closed the non-brokered private placement

of units (“Units”) announced in its October 17, 2025 news release (the “Financing”).

The Company raised a total of US$7,000,000 through the sale of 28,000,000 units (each a “Unit”) at

a price of US$0.25 per Unit (~CDN$0.35 per Unit). Each Unit consists of one share of common stock

(a “Share”) and one common share purchase warrant (a “Warrant”). Each Warrant entitles the holder

to purchase an additional Share of the Company at an exercise price of US$0.45 (~CDN$0.63) until

October 24, 2028.

The Company has paid finder’s fees in accordance with CSE policies of US$1,500 and issued a total

of 6,000 finder’s warrants, with each finder’s warrant entitling the holder to acquire one Share at

a price of US$0.45 until October 24, 2028.

Rise would like to thank each of the subscribers who participated in this private placement to

support the Company’s efforts to unlock the value of the historic Idaho-Maryland-Brunswick Mine

(the “IM Mine”).

The IM Mine produced 2.4 million ounces at a mill grade of 17 grams per tonne from the 1860s to

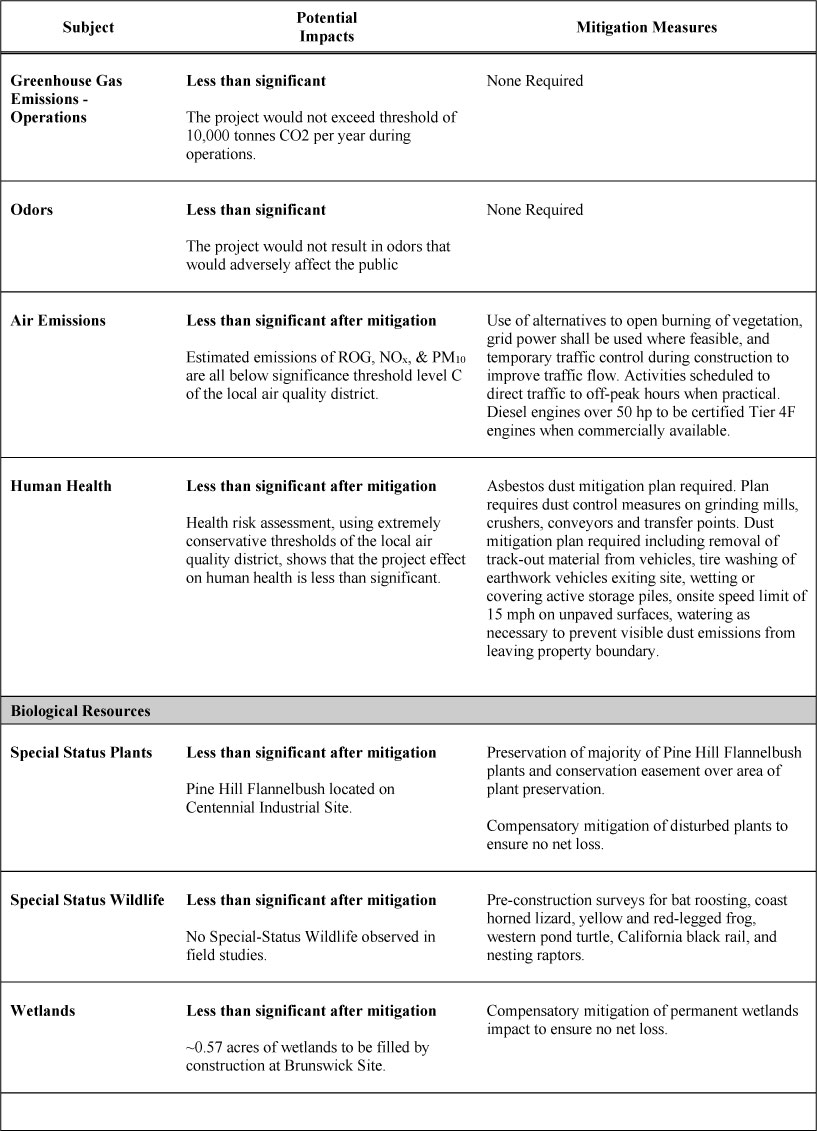

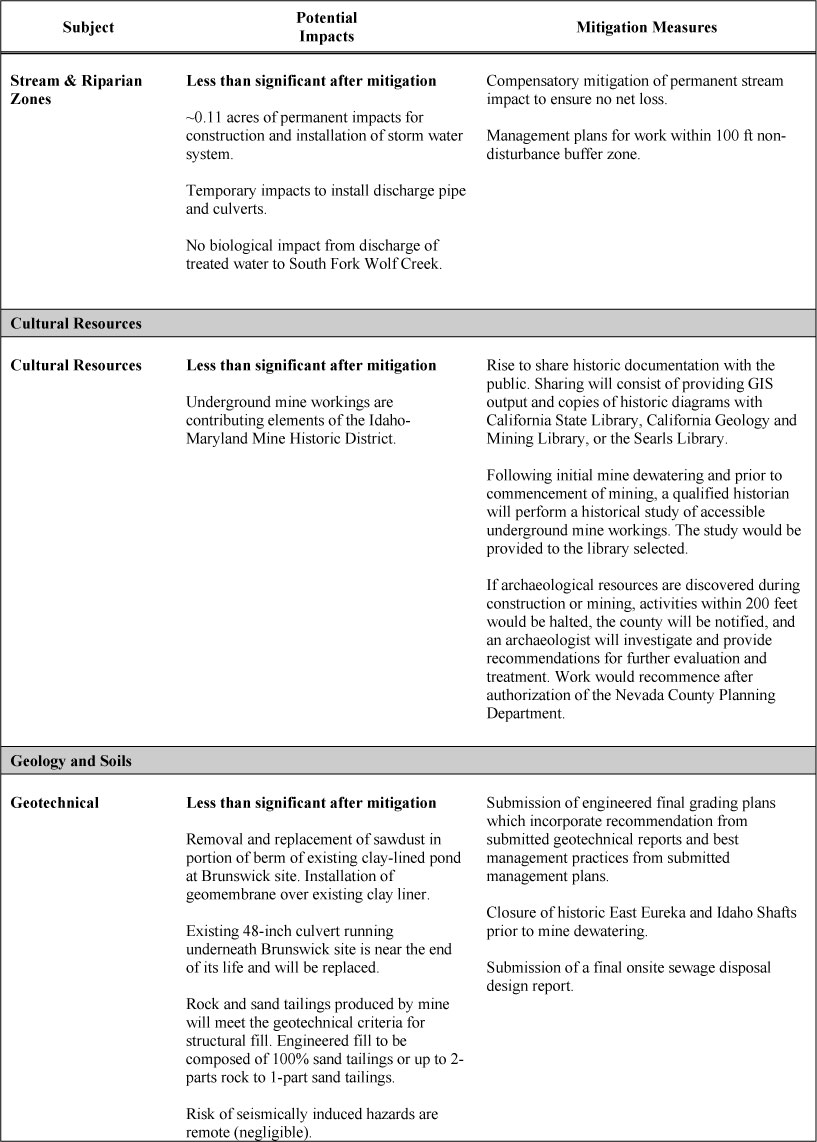

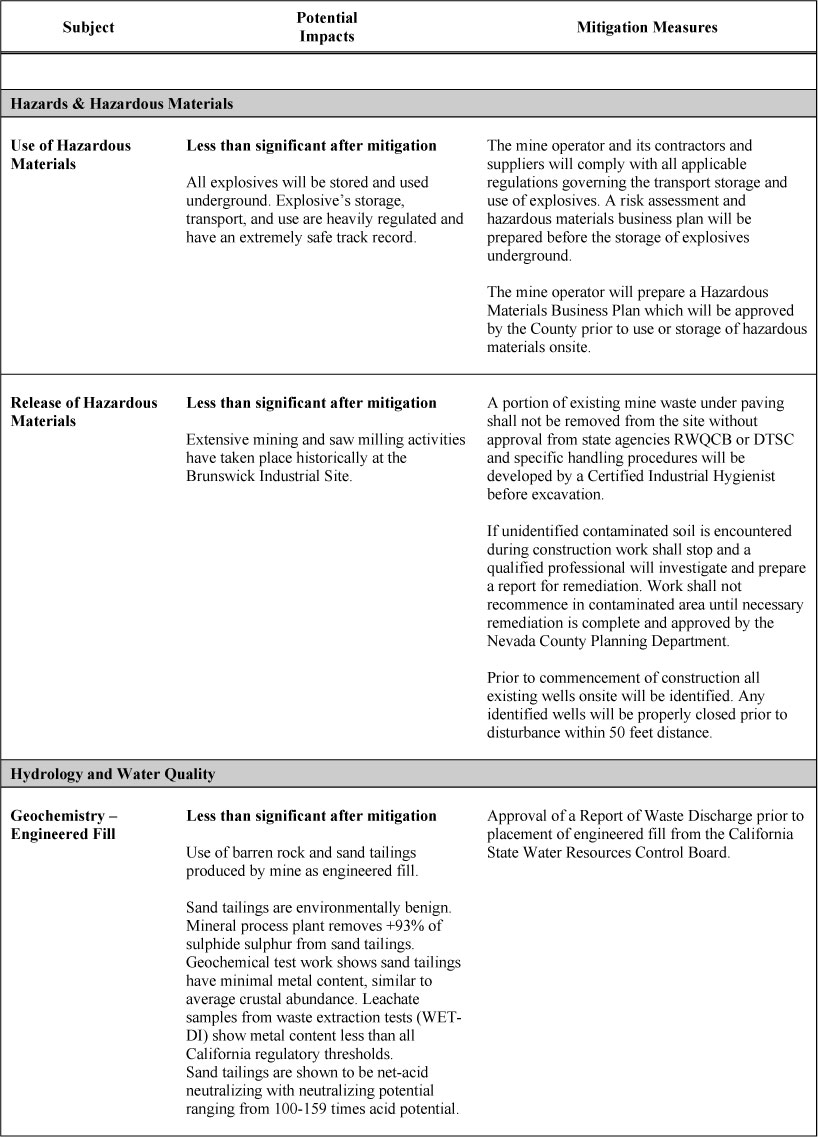

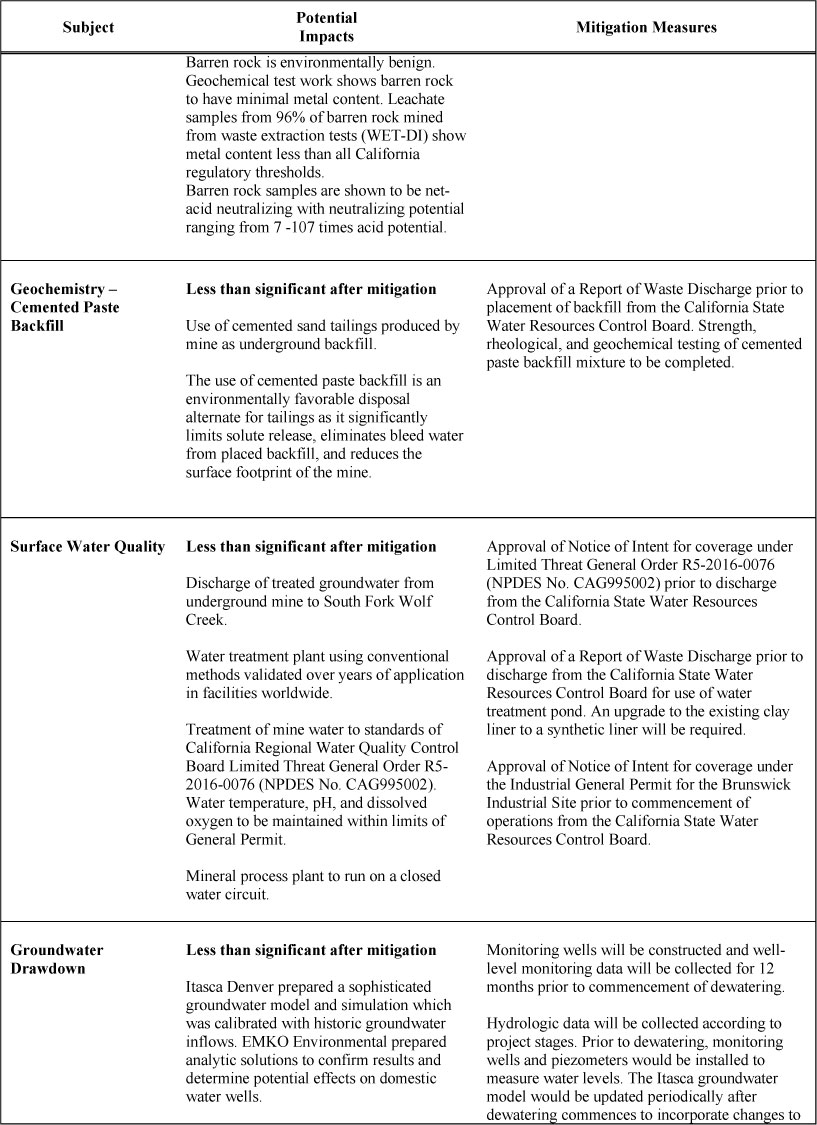

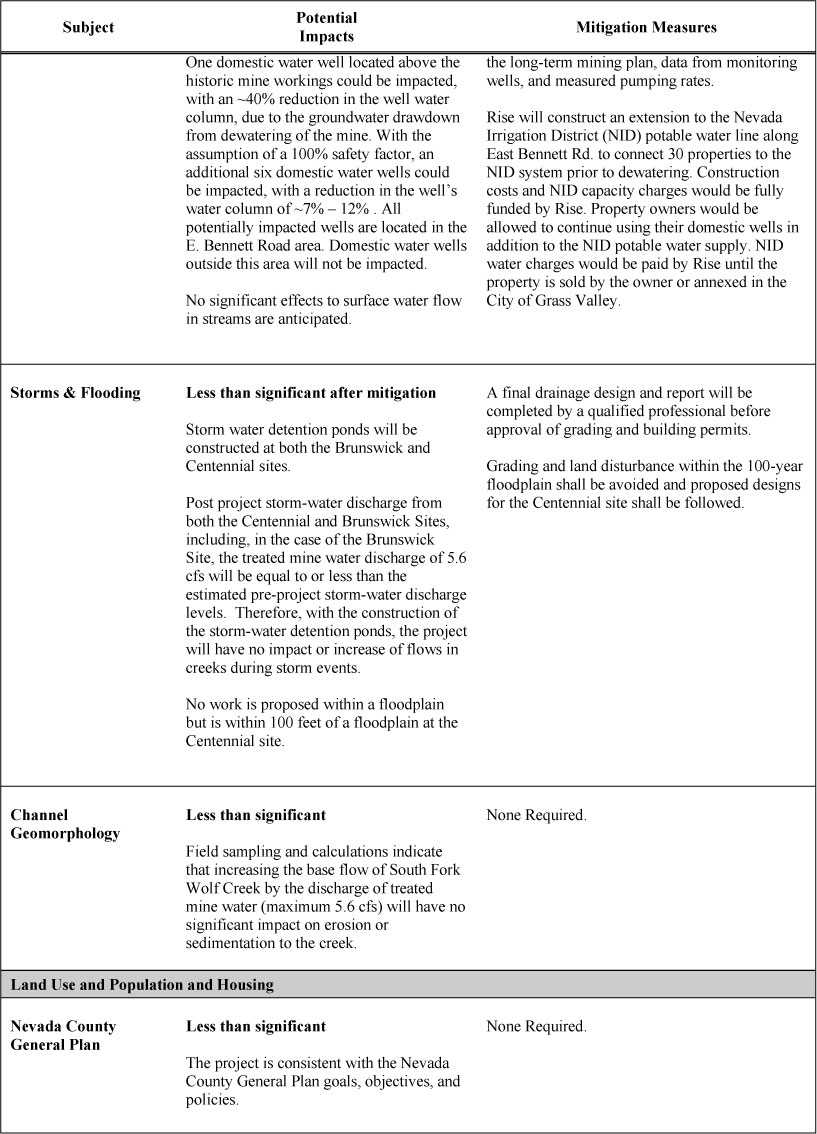

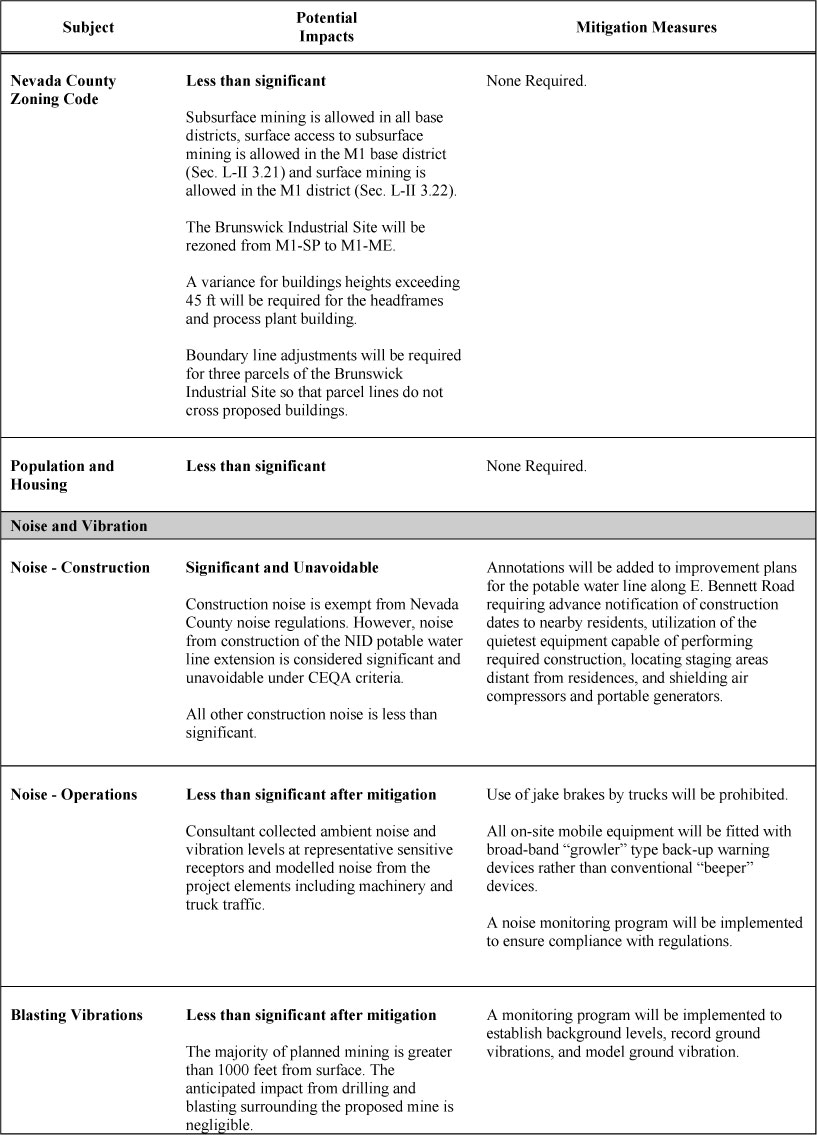

1956. In 2023, Nevada County (the “County”) published an Environmental Impact Report comprised of

more than 40,000 pages that concluded that all of the environmental impacts of Rise’s proposed

project could be mitigated to a “less than significant” effect with three minor exceptions: visual

changes to Rise’s surface property, temporary noise related to construction, and some traffic

effects at a single intersection.

County Supervisors then denied Rise’s permit application on spurious grounds. As previously

disclosed by a news release (https://www.risegoldcorp.com/news_items) issued on September 16, 2025,

the Company expects that in the first quarter of 2026 the Superior Court will render its decision

on Rise’s writ of mandamus filed against the County with regards to the Company’s vested right to

operate the mine. Should the Court reject Rise’s writ, the County will have taken Rise’s mineral

estate and will owe just compensation—the fair market value of the property taken—under the Fifth

Amendment of the U.S. Constitution. Based on comparable mines and historic yields at the I-M Mine,

management believes the fair market value of Rise’s mineral estate

is at least $400 million.

The Company would like to thank especially Abdiel Capital Advisors, which invested US$3.6 million

in this Financing and now owns 12% of the Company on an undiluted basis, as well as Equinox

Partners, which invested US$1.4 million in this Financing to retain its 19.8% undiluted interest in

the Company. Myrmikan Gold Fund also participated, investing US$250,000, which puts its undiluted

ownership stake in the Company at 12.2%.

Joe Mullin, President and CEO, stated: “We are pleased to have Abdiel as a shareholder and also

that Equinox retained its 19.8% interest in the Company. Rise is now fully financed to expand its

litigation efforts to allow the I-M Mine to move forward towards development.”

Certain directors and officers of Rise Gold, directly, through entities controlled by them, or

through entities for which they exercise control or direction over investment decisions, purchased

an aggregate of 1,080,000 Units for gross proceeds of US$270,000. The participation of these

directors and officers in the Financing constitutes a “related party transaction” under

Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI

61-101”). Rise Gold is relying on exemptions from the formal valuation requirements of section 5.4

of MI 61-101 and minority shareholder approval requirements of section 5.6 of MI 61-101. As the

fair market value of the related parties’ participation is not more than 25% of Rise Gold’s market

capitalization, the related party transaction is exempt from the formal valuation requirements

pursuant to subsection 5.5(a) of MI 61-101 and from the minority approval requirements pursuant to

subsection 5.7(1)(a) of MI 61-101. A material change report, as contemplated by the related party

transaction requirements under MI 61-101, was not filed more than 21 days prior to closing as the

extent of related party participation in the Financing was not known until shortly prior to the

closing.

All securities issued pursuant to the Financing are subject to statutory hold periods in accordance

with applicable United States and Canadian securities laws. Under Canadian securities laws the

securities are subject to a hold period expiring on February 25, 2026. Rise Gold will use the

proceeds from the Financing for general working capital, legal expenses, and technical work.

The securities offered have not been registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”), or any state securities laws and may not be offered or sold

absent registration or compliance with an applicable exemption from the registration requirements

of the U.S. Securities Act and applicable state securities laws.

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

On behalf of the Board of Directors:

Joseph Mullin

President and CEO

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

Suite 215, 333 Crown Point Circle Grass Valley, CA 95945

T: 917.349.0060

jmullin@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of applicable

securities laws. Forward-looking statements are frequently characterized by words such as “plan”,

“expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words or

statements that certain events or conditions “may” or “will” occur. This information and these

statements are not historical facts, are made as of the date of this news release and include

without limitation, statements regarding discussions of future plans, estimates and forecasts and

statements as to management’s expectations and intentions with respect to, among other things, the

anticipated use of the proceeds raised under the Financing, the potential reopening of the IM Mine,

the anticipated timing of the Superior Court decision on Rise’s writ of mandamus, and the expected

fair market value of Rise’s mineral estate.

Although the Company believes that the expectations reflected in the forward-looking statements are

reasonable, there can be no assurance that such expectations will prove to be correct. Such

forward-looking statements are subject to risks, uncertainties and assumptions related to certain

factors including, without limitation, the risk that the Company will not be able to utilize the

proceeds of the Financing as anticipated, the risk that the Superior Court will not render its

decision on the timing anticipated, obtaining all necessary approvals, meeting expenditure and

financing requirements, compliance with environmental regulations, title matters, operating

hazards, metal prices, political and economic factors, competitive factors, general economic

conditions, relationships with vendors and strategic partners, governmental regulation and

supervision, seasonality, technological change, industry practices, and one-time events that may

cause actual results, performance or developments to differ materially from those contained in the

forward- looking statements. Accordingly, readers should not place undue reliance on

forward-looking statements and information contained in this release. Rise undertakes no obligation to update forward-looking statements or information except as required by law.

Rise Gold Announces Financing Up To US$7,000,000

(Show News Item)

October 17, 2025 – Grass Valley, California – Rise Gold Corp. (CSE: RISE, OTCQB: RYES) (the “Company” or “Rise Gold”) announces that it intends to raise up to US$7,000,000 through the issuance of up to 28,000,000.00 units (each a “Unit”) at a price of US$0.25 per Unit (~CDN$0.35 per Unit), with each Unit consisting of one share of common stock (a “Share”) and one share purchase warrant (the “Private Placement”). Each share purchase warrant entitles the holder to acquire one Share at an exercise price of US$0.45 (~CDN$0.63) for a period of three (3) years from the date of issuance.

Rise Gold will use the proceeds from the Private Placement for general working capital, legal expenses, and technical work. All securities issued pursuant to the offering will be subject to statutory hold periods in accordance with applicable United States and Canadian securities laws.

The Company anticipates a closing late October 2025.

The securities offered have not been registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws and may not be offered or sold absent registration or compliance with an applicable exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws.

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

On behalf of the Board of Directors:

Joseph Mullin

President and CEO

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

345 Crown Point Circle, Suite 600

Grass Valley, CA 95945

T: 917.349.0060

jmullin@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words or statements that certain events or conditions “may” or “will” occur. Examples of such forward-looking statements include, but are not limited to, statements with regard to the completion of the Private Placement and the timing thereof, and the intended use of proceeds of the Private Placement.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks, uncertainties and assumptions related to certain factors including, without limitation, obtaining all necessary approvals for the Private Placement, the ability of the Company to complete the Private Placement on the timing anticipated, the ability of the Company to utilize the proceeds of the Private Placement as anticipated, meeting expenditure and financing requirements, compliance with environmental regulations, title matters, operating hazards, metal prices, political and economic factors, competitive factors, general economic conditions, relationships with vendors and strategic partners, governmental regulation and supervision, seasonality, technological change, industry practices, and one-time events that may cause actual results, performance or developments to differ materially from those contained in the forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements and information contained in this release. Rise Gold undertakes no obligation to update forward-looking statements or information except as required by law.

Rise Gold Announces Progress in its Legal Efforts to Unlock the Value of the Idaho-Maryland Mine

(Show News Item)

September 16, 2025 – Grass Valley, California – Rise Gold Corp. (CSE: RISE, OTCQB: RYES) (the “Company”) is pleased to announce progress in its legal efforts to unlock the value of Company’s wholly-owned Idaho-Maryland Mine (the “I-M Mine”), which operated from 1862 to 1957 and produced an estimated 2.4 million ounces of gold at an average mill head grade of 0.50 ounces per ton (17.1 grams per tonne).

Nevada County, California (the “County”) adopted its first comprehensive zoning ordinance in 1954 that required obtaining a permit to engage in underground mining. Because the I-M Mine was in production before, during, and after the zoning ordinance was adopted, it obtained a vested right to continue mining without a permit (otherwise, adopting the ordinance would have been a taking under the Fifth Amendment of the U.S. Constitution).

On September 6, 2023, the Company submitted a petition to the County asserting its constitutionally-protected vested right to mine at the I-M Mine without a use permit. On December 14, 2023, the Board of Supervisors (the “Board”) of the County rejected the Company’s vested rights petition because “all mining activities at both the Brunswick and Centennial cites [sic] had ceased by 1956.”

Previously, in the 1990s, the County rejected a vested right petition from the Bear's Elbow Mine because, the County argued, as it does now, that a vested right expires when operations cease. The Supreme Court of California disagreed and ruled in the seminal 1996 case Hansen Bros. Enter., Inc. v. Nevada Cnty. Bd. of Supervisors that “cessation of use alone does not constitute abandonment” of a vested right to a nonconforming use.

The Board concluded as well that if there were a vested right to operate the I-M Mine, it had been abandoned, arguing: “In order to avoid a finding of abandonment, the property owner must be able to identify evidence of their objective manifestation of intent to resume the nonconforming use throughout the period the nonconforming use was discontinued.” The Board’s finding is directly contrary to the holding in Hansen Bros., which places the burden of proof to show abandonment on the County: “Abandonment of a nonconforming use ordinarily depends upon a concurrence of two factors: (1) an intention to abandon; and (2) an overt act, or failure to act, which carries the implication the owner does not claim or retain any interest in the right to the nonconforming use.”

On May 13, 2024, the Company submitted a Writ of Mandamus (the “Writ”) to the Superior Court of California for the County of Nevada (the “Court”) asking the Court to compel the Board to follow applicable law and grant Rise recognition of its vested right to operate the I-M Mine.

Subsequent to filing the Writ, Rise sold three non-core surface parcels to repay debt and obtain the funds necessary to litigate the writ. The County brought a motion for summary judgement in the writ proceedings, arguing that Rise had lost standing because of the sale of the parcels.

On August 8, 2025, the Court rejected the County’s motion, ruling: “Rise [has] a beneficial interest in the mine property it owns that is the subject of its vested right petition: if its vested right to mine is recognized, Rise possesses all of the surface and mineral estate necessary to begin mining.”

On September 12, the Court signed a stipulation from the County and Rise providing that Rise would submit its initial brief1 on the case yesterday, September 15, the County will submit its opposition by November 18, Rise to reply by December 5, and oral arguments will take place on January 9, 2026.

Megan Wold, a partner of the litigation firm Cooper & Kirk, which is representing Rise, commented: “Constitutional rights do not simply expire, and they can be abandoned only knowingly and intentionally. The County points out that underground mining ceased in 1956; but it could not point to a single credible example of a manifest intent to abandon the right to mine nor any overt act that would imply abandonment, both of which the law requires the County to show by clear and convincing evidence.”

The Board argued, for example, that the operator of the I-M Mine abandoned its right to mine because it “changed its name to remove any reference to the word ‘mine,’” that is, from Idaho Maryland Mines Corporation to Idaho Maryland Industries Inc. Wold added: “The County’s arguments do not withstand scrutiny. The Board is clearly confused about the applicable legal standards or failed to engage in an objective assessment of the evidence.”

During the County’s hearing on the vested rights, Supervisor Hoek said: “I feel like this is above my paygrade to be totally honest.” Supervisor Hall commented: “It is very unfortunate and difficult for us because we’re not lawyers, this isn’t a courtroom, and we’re not judges.” Supervisor Scofield declined to exercise any judgement, saying: “Since all of the points will apparently be argued to a higher authority, I am comfortable following the recommendations of the Nevada County Staff.”

Joe Mullin, CEO of Rise Gold, commented: “It is unfortunate that the County decided to waste public resources relitigating the Hansen Bros. case, which it lost badly. Though adjudicating the writ has taken longer than we first anticipated, we are glad that the County has agreed to a reasonable schedule, and we are confident that an experienced judge deliberating the facts according to the clear precedent set by the California Supreme Court will conclude that Rise has a vested right to operate the I-M Mine.”

As Cooper & Kirk made clear to the Board of Supervisors, should the Company be denied the right to mine, the County will have taken Rise’s mineral estate and will owe just compensation—the fair market value of the property taken—under the Fifth Amendment of the U.S. Constitution.

Based on comparable mines and historic yields at the I-M Mine, management believes the fair market value of Rise’s mineral estate is at least $400 million. In the event that the Company loses its case in Superior Court and is denied a vested right to mine, management intends to file a federal lawsuit to vindicate the Company’s Fifth Amendment right to just compensation.

Footnote

1. The brief that Rise filed with the Court in support of its vested rights may be found at the following link: https://www.risegoldcorp.com/litigation

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

On behalf of the Board of Directors:

Joseph Mullin

President and CEO

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

345 Crown Point Circle, Suite 600

Grass Valley, CA 95945

T: 917.349.0060

jmullin@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words or statements that certain events or conditions “may” or “will” occur.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks, uncertainties and assumptions related to certain factors including, without limitation, obtaining all necessary approvals, meeting expenditure and financing requirements, compliance with environmental regulations, title matters, operating hazards, metal prices, political and economic factors, competitive factors, general economic conditions, relationships with vendors and strategic partners, governmental regulation and supervision, seasonality, technological change, industry practices, and one-time events that may cause actual results, performance or developments to differ materially from those contained in the forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements and information contained in this release. Rise undertakes no obligation to update forward-looking statements or information except as required by law.

Rise Gold Announces Closing of Second Sale of Industrial Land and Paying Off the Secured Debt

(Show News Item)

May 29, 2025 – Grass Valley, California – Rise Gold Corp. (CSE: RISE, OTCQB: RYES) (the “Company”) announces it has closed the second sale agreement of land for a sale price of $2.5 million.

On November 27, 2024, Rise announced the sale of 66 acres of industrial land located adjacent to the Company’s Idaho-Maryland Mine Property (the “I-M Mine Property”) for $4.3 million to an arm’s length third party in two transactions. The first of these transactions covered 16 acres of land for total consideration of $1.8 million, including $900,000 at closing, minus certain transaction fees, and an additional $900,000 due on November 27, 2026. Rise negotiated a discounted, accelerated payment with the purchaser whereby the Company received $702,000 on January 15, 2025 in lieu of the payment due in 2026.

The second sale agreement covered 50 acres of land for a total sale price of $2.5 million and this transaction closed on May 27, 2025, with half of the sale price paid on closing and the other half due on May 27, 2027. Commencing on the closing date, the buyer will pay monthly interest at an annual rate of 5% per year on the balance of the purchase price until it is paid in full. A portion of the proceeds totaling $680,000 was allocated to pay off the remaining balance of the Company’s secured debt, and the balance of the funds is available to the Company to support operations and its legal claims against Nevada County (“the County”).

Rise and the purchaser have also executed an option agreement whereby the Company may repurchase the 66 acres of land being sold for the sale price plus the cost of any capital improvements plus an increase of five percent per year on the condition that Rise acquires final government approval to perform mining operations at the I-M Mine Property.

The Company retains ownership of the I-M Mine Property, which is comprised of 53 acres of land surrounding the New Brunswick shaft, as well as its nearby 56-acre Centennial property, and it retains all of its 2,585 acres of mineral rights.

As previously disclosed in its press release dated May 13, 2024, the Company has submitted a Writ of Mandamus (the “Writ”) to the Superior Court of California for the County of Nevada (the “Court”) asking the Court to compel the Board of Supervisors of Nevada County to follow applicable law and grant Rise recognition of its constitutionally-protected, grandfathered vested right to operate the Mine.

Rise’s litigation attorneys at Cooper & Kirk have advised the Company that should the Writ be unsuccessful, Rise’s mineral estate will lose all value, which will allow Rise to bring a takings action in federal court against the County under the Fifth Amendment of the U.S. Constitution. The remedy for an unconstitutional taking is the payment of just compensation, which is the fair market value of the property taken. Based on comparable mines and historic yields at the I-M Mine, management believes the fair market value of Rise’s mineral estate is at least $400 million.

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

On behalf of the Board of Directors:

Joseph Mullin

President and CEO

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

345 Crown Point Circle, Suite 600

Grass Valley, CA 95945

T: 917.349.0060

jmullin@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words or statements that certain events or conditions “may” or “will” occur.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks, uncertainties and assumptions related to certain factors including, without limitation, obtaining all necessary approvals, meeting expenditure and financing requirements, compliance with environmental regulations, title matters, operating hazards, metal prices, political and economic factors, competitive factors, general economic conditions, relationships with vendors and strategic partners, governmental regulation and supervision, seasonality, technological change, industry practices, and one-time events that may cause actual results, performance or developments to differ materially from those contained in the forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements and information contained in this release. Rise undertakes no obligation to update forward-looking statements or information except as required by law.

Rise Gold Grants Stock Options

(Show News Item)

May 22, 2025 – Grass Valley, California – Rise Gold Corp. (CSE: RISE, OTCQB: RYES) (the “Company” or “Rise Gold”) announces that it has granted a total of 3,320,000 stock options to directors, officers, and consultants of the Company pursuant to the terms of the Company’s Stock Option Plan. The stock options are exercisable at a price of US$0.10 (CAD$0.14) per share until May 22, 2030.

The Company also announces that it has entered into an agreement to receive investor relations services from Millstream Partners. Millstream Partners’ contact information is: 4 Ducking Stool Walk, Christchurch, England, BH231GA, telephone: (+44)7726655975, email: MillstreamPartners@proton.me. The contract starts on May 22, 2025, and has an initial term of four months. Rise Gold will pay US$8,000 per month to Millstream Partners in exchange of services that include organizing of meetings and events in person or online with individuals and organizations interested in investing in the mining sector. The compensation paid to Millstream Partners does not include options to purchase securities of Rise Gold.

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

On behalf of the Board of Directors:

Joseph Mullin

President and CEO

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

345 Crown Point Circle, Suite 600

Grass Valley, CA 95945

T: 917.349.0060

jmullin@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Rise Gold Closes $3,000,000 Financing including Strategic Investor Equinox Partners

(Show News Item)

May 9, 2025 – Grass Valley, California – Rise Gold Corp. (CSE: RISE, OTCQB: RYES) (the “Company” or “Rise”) is pleased to announce that it has closed the non-brokered private placement of units (“Units”) announced in its April 23, 2025 news release (the “Financing”).

The Company raised a total of US$3,000,000 through the sale of 36,585,361 units (each a “Unit”) at a price of US$0.082 per Unit. Each Unit consists of one share of common stock (a “Share”) and one half of a common share purchase warrant (each whole warrant a “Warrant”). Each Warrant entitles the holder to purchase an additional Share of the Company at an exercise price of US$0.15 within three years of closing.

The Company has paid finder’s fees in accordance with CSE policies of US$3,000 and issued a total of 36,585 finder’s warrants, with each finder’s warrant entitling the holder to acquire one Share at a price of US$0.15 until May 8, 2028.

Rise would like to thank each of the subscribers who participated in this private placement to support the Company’s efforts to unlock the value of the historic Idaho-Maryland-Brunswick Mine (the “IM Mine”). The IM Mine produced 2.4 million ounces at a mill grade of 17 grams per tonne from the 1860s to 1956. Production peaked at 121,000 ounces in 1940 at 12.9 g/t before a workers’ strike in 1941 and forced closure by the War Department in 1942. The owner of the IM Mine had been in the process of doubling production throughput when the government forced the mine to close to reallocate resources to the war effort.

The Company would like to thank especially Equinox Partners, which invested US$1.5 million in this private placement and now owns 19.8% of the Company on an undiluted basis. Equinox Partners has a twenty-five-year track record investing in precious metals and other resource sectors. Myrmikan Gold Fund also participated, investing US$532,208.

Joe Mullin, President and CEO, stated: “We are pleased to have Equinox make this investment in Rise Gold, initiating a strategic relationship that will contribute to the reopening of the Idaho-Maryland Mine.”

The Company also announces that it has renegotiated its debt agreement with Eridanus Capital LLC (“Eridanus”) previously announced in its September 3, 2019 news release. Eridanus is an affiliate of Myrmikan Capital, LLC, which operates in the gold and silver junior mining sector. Eridanus has agreed to extend the maturity date of the loan to September 4, 2027 and to reduce the interest rate to 15% for the duration of the debt facility.

Certain directors and officers of Rise Gold, directly, through entities controlled by them, or through entities for which they exercise control or direction over investment decisions, purchased an aggregate of 9,904,196 Units for gross proceeds of US$812,144. The participation of these directors and officers in the Private Placement constitutes a “related party transaction” under Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101”). Rise Gold is relying on exemptions from the formal valuation requirements of section 5.4 of MI 61-101 and minority shareholder approval requirements of section 5.6 of MI 61-101. As the fair market value of the related parties’ participation is not more than 25% of Rise Gold’s market capitalization, the related party transaction is exempt from the formal valuation requirements pursuant to subsection 5.5(a) of MI 61-101 and from the minority approval requirements pursuant to subsection 5.7(1)(a) of MI 61-101. A material change report, as contemplated by the related party transaction requirements under MI 61-101, was not filed more than 21 days prior to closing as the extent of related party participation in the Private Placement was not known until shortly prior to the closing.

All securities issued pursuant to the Financing are subject to statutory hold periods in accordance with applicable United States and Canadian securities laws. Under Canadian securities laws the securities are subject to a hold period expiring on September 9, 2025. Rise Gold will use the proceeds from the Financing for general working capital, debt repayment, and settlement of related party fees.

The securities offered have not been registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws and may not be offered or sold absent registration or compliance with an applicable exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws.

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

On behalf of the Board of Directors:

Joseph Mullin

President and CEO

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

Suite 215, 333 Crown Point Circle

Grass Valley, CA 95945

T: 917.349.0060

jmullin@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words or statements that certain events or conditions “may” or “will” occur. This information and these statements are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management’s expectations and intentions with respect to, among other things, the anticipated use of the proceeds raised under the Financing and the reopening of the IM Mine.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks, uncertainties and assumptions related to certain factors including, without limitation, the risk that the Company will not be able to utilize the proceeds of the Financing as anticipated, obtaining all necessary approvals, meeting expenditure and financing requirements, compliance with environmental regulations, title matters, operating hazards, metal prices, political and economic factors, competitive factors, general economic conditions, relationships with vendors and strategic partners, governmental regulation and supervision, seasonality, technological change, industry practices, and one-time events that may cause actual results, performance or developments to differ materially from those contained in the forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements and information contained in this release. Rise undertakes no obligation to update forward-looking statements or information except as required by law.

Rise Gold Announces US$3,000,000 Financing

(Show News Item)

April 23, 2025 – Grass Valley, California – Rise Gold Corp. (CSE: RISE, OTCQB: RYES) (the “Company” or “Rise Gold”) announces that it intends to raise up to US$3,000,000 through the issuance of up to 36,585,365 units (each a “Unit”) at a price of US$0.082 per Unit (~CDN$0.11 per Unit), with each Unit comprising one share of common stock (a “Share”) and one-half of one share purchase warrant (the “Private Placement”). Each whole warrant (a “Warrant”) entitles the holder to acquire one Share at an exercise price of US$0.15 (~CDN$0.21) for a period of three (3) years from the date of issuance.

Rise Gold will use the proceeds from the Private Placement for general working capital. All securities issued pursuant to the Offering will be subject to statutory hold periods in accordance with applicable United States and Canadian securities laws.

The Company anticipates a closing early May 2025.

The securities offered have not been registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws and may not be offered or sold absent registration or compliance with an applicable exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws.

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

On behalf of the Board of Directors:

Joseph Mullin

President and CEO

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

Suite 215, 333 Crown Point Circle

Grass Valley, CA 95945

T: 530.433.0188

info@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words or statements that certain events or conditions “may” or “will” occur. Examples of such forward-looking statements include, but are not limited to, statements with regard to the completion of the Private Placement and the timing thereof, and the intended use of proceeds of the Private Placement.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks, uncertainties and assumptions related to certain factors including, without limitation, obtaining all necessary approvals for the Private Placement, the ability of the Company to complete the Private Placement on the timing anticipated, the ability of the Company to utilize the proceeds of the Private Placement as anticipated, meeting expenditure and financing requirements, compliance with environmental regulations, title matters, operating hazards, metal prices, political and economic factors, competitive factors, general economic conditions, relationships with vendors and strategic partners, governmental regulation and supervision, seasonality, technological change, industry practices, and one-time events that may cause actual results, performance or developments to differ materially from those contained in the forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements and information contained in this release. Rise undertakes no obligation to update forward-looking statements or information except as required by law.

Rise Gold Announces Receipt of $702,000 with Regards to Property Sale

(Show News Item)

January 16, 2025 – Grass Valley, California – Rise Gold Corp. (CSE: RISE, OTCQX: RYES) (the “Company”) announces it has received a $702,000 payment with regards to the sale of property.

On November 27, 2024, Rise announced the sale of 66 acres of industrial land located adjacent to the Company’s Idaho-Maryland Mine Property (the “I-M Mine Property”) for $4.3 million to an arm’s length third party in two transactions. The first of these transactions covered 16 acres of land for total consideration of $1.8 million, including $900,000 at closing, minus certain transaction fees, and an additional $900,000 due on November 27, 2026. Rise negotiated a discounted, accelerated payment with the purchaser whereby the Company received $702,000 on January 15, 2025 in lieu of the payment due in 2026. While the first tranche of $900,000 received in November 2024 was allocated to reduce the Company’s secured debt, the $702,000 received on January 15, 2025 is available to fund ongoing operations.

The second sale agreement covers 50 acres of land for total sale price of $2.5 million and is expected to close on May 26, 2025, at which point half of the sale price will be due, with the other half due on May 26, 2027. The buyer has placed $200,000 in escrow and is paying $12,500 per month in rent until closing, with the rent payments to be applied against the purchase price. Commencing on the closing date, the buyer will pay monthly interest at an annual rate of 5% per year on the balance of the purchase price until it is paid in full.

Rise and the purchaser have also executed an option agreement whereby the Company may repurchase the 66 acres of land being sold for the sale price plus the cost of any capital improvements plus an increase of five percent per year on the condition that Rise acquires final government approvals to perform mining operations at the I-M Mine Property.

The Company retains ownership of the I-M Mine Property, which is comprised of 53 acres of land surrounding the New Brunswick shaft, as well as its nearby 56-acre Centennial property, and it retains all of its 2,585 acres of mineral rights.

The Company will use the sale proceeds to repay debt and to fund its legal claims against Nevada County (the “County”). As previously disclosed in its press release dated May 13, 2024, the Company has submitted a Writ of Mandamus (the “Writ”) to the Superior Court of California for the County of Nevada (the “Court”) asking the Court to compel the Board of Supervisors of Nevada County to follow applicable law and grant Rise recognition of its constitutionally-protected, grandfathered vested right to operate the Mine.

Rise’s litigation attorneys at Cooper & Kirk have advised the Company that should the Writ be unsuccessful, Rise’s mineral estate will lose all value, which will allow Rise to bring a takings action in federal court against the County under the Fifth Amendment of the U.S. Constitution. The remedy for an unconstitutional taking is the payment of just compensation, which is the fair market value of the property taken. Based on comparable mines and historic yields at the I-M Mine, management believes the fair market value of Rise’s mineral estate is at least $400 million.

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

On behalf of the Board of Directors:

Joseph Mullin

President and CEO

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

Suite 215, 333 Crown Point Circle

Grass Valley, CA 95945

T: 530.433.0188

info@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words or statements that certain events or conditions “may” or “will” occur.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks, uncertainties and assumptions related to certain factors including, without limitation, obtaining all necessary approvals, meeting expenditure and financing requirements, compliance with environmental regulations, title matters, operating hazards, metal prices, political and economic factors, competitive factors, general economic conditions, relationships with vendors and strategic partners, governmental regulation and supervision, seasonality, technological change, industry practices, and one-time events that may cause actual results, performance or developments to differ materially from those contained in the forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements and information contained in this release. Rise undertakes no obligation to update forward-looking statements or information except as required by law.

Rise Gold Announces $4.3 Million Sale of Property

(Show News Item)

November 27, 2024 – Grass Valley, California – Rise Gold Corp. (CSE: RISE, OTCQX: RYES) (the “Company”) announces it has contracted to sell 66 acres of industrial land located adjacent to the Company’s Idaho-Maryland Mine Property (the “I-M Mine Property”) for $4.3 million. Prior to 1991, the land being sold hosted a major commercial lumber mill, which had previously provided timber to the I-M Mine when it was in operation. All buildings associated with the lumber mill have been removed.

The sale transaction is subject to two sale agreements with the same, arm’s length third party. The first agreement covers 16 acres of land for total consideration of $1.8 million. That contract closed today, November 27, with the payment of half the sale price, minus certain deductions. The balance of the purchase price is due on November 27, 2026. The buyer will pay monthly interest at an annual rate of 5% per year on the balance of the purchase price until it is paid in full.

The second sale agreement covers 50 acres of land for total sale price of $2.5 million and is expected to close on May 26, 2025, at which point half of the sale price will be due, with the other half due on May 26, 2027. The buyer has placed $200,000 in escrow and will pay $12,500 per month in rent until closing, with the rent payments to be applied against the purchase price. Commencing on the closing date, the buyer will pay monthly interest at an annual rate of 5% per year on the balance of the purchase price until it is paid in full.

Rise and the purchaser have also executed an option agreement whereby the Company may repurchase the 66 acres of land being sold for the sale price plus the cost of any capital improvements plus an increase of five percent per year on the condition that Rise acquires final government approvals to perform mining operations at the I-M Mine Property.

The Company retains ownership of the I-M Mine Property, which is comprised of 53 acres of land surrounding the New Brunswick shaft, as well as its nearby 56-acre Centennial property, and it retains all of its 2,585 acres of mineral rights.

The Company will use the sale proceeds to repay debt and to fund its legal claims against Nevada County (the “County”). As previously disclosed in its press release dated May 13, 2024, the Company has submitted a Writ of Mandamus (the “Writ”) to the Superior Court of California for the County of Nevada (the “Court”) asking the Court to compel the Board of Supervisors of Nevada County to follow applicable law and grant Rise recognition of its constitutionally-protected, grandfathered vested right to operate the Mine.

Rise’s litigation attorneys at Cooper & Kirk have advised the Company that should the Writ be unsuccessful, Rise’s mineral estate will lose all value, which will allow Rise to bring a takings action in federal court against the County under the Fifth Amendment of the U.S. Constitution. The remedy for an unconstitutional taking is the payment of just compensation, which is the fair market value of the property taken. Based on comparable mines and historic yields at the I-M Mine, management believes the fair market value of Rise’s mineral estate is at least $400 million.

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

On behalf of the Board of Directors:

Joseph Mullin

President, CEO and Director

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

345 Crown Point Circle, Suite 600

Grass Valley, California, USA 95945

T: 530.433.0188

info@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words or statements that certain events or conditions “may” or “will” occur.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks, uncertainties and assumptions related to certain factors including, without limitation, obtaining all necessary approvals, meeting expenditure and financing requirements, compliance with environmental regulations, title matters, operating hazards, metal prices, political and economic factors, competitive factors, general economic conditions, relationships with vendors and strategic partners, governmental regulation and supervision, seasonality, technological change, industry practices, and one-time events that may cause actual results, performance or developments to differ materially from those contained in the forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements and information contained in this release. Rise undertakes no obligation to update forward-looking statements or information except as required by law.

Rise Gold Announces Change of Officers

(Show News Item)

November 22, 2024 – Grass Valley, California – Rise Gold Corp. (CSE: RISE, OTCQX: RYES) (the “Company”) announces that it has appointed Mihai Draguleasa as the Company’s Chief Financial Officer in place of Vince Boon, and Catherine Cox as the Company’s Corporate Secretary in place of Eileen Au. The Company wishes to thank Mr. Boon and Ms. Au for their many contributions to the Company.

Mihai Draguleasa, CPA

Mr. Draguleasa is a Chartered Professional Accountant (CPA) with over 15 years of accounting experience including that in the mining and resource sector. His career developed with Deloitte LLP and Ernst & Young in Vancouver, British Columbia. The mining related financial experience includes financial reporting, corporate risk management, corporate strategy and planning, and investment evaluation.

Catherine Cox

Ms. Cox has over 20 years of experience as Corporate Secretary to a variety of public and private companies in the resource sector. She was the former VP- Corporate Secretary for Nevada Copper Corp. and has an extensive securities and corporate paralegal background working with both Canadian and US law firms.

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

On behalf of the Board of Directors:

Joseph Mullin

President, CEO and Director

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

345 Crown Point Circle, Suite 600

Grass Valley, CA, USA 95945

T: 530.433.0188

info@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Rise Gold Announces Results from Annual General Meeting

(Show News Item)

November 20, 2024 – Grass Valley, California – Rise Gold Corp. (CSE: RISE, OTCQX: RYES) (the “Company”) announces that all proposed resolutions were passed at the Company’s annual general meeting of shareholders held today’s date. Joseph E. Mullin III, Thomas I. Vehrs, Lawrence W. Lepard, Daniel Oliver Jr. and Clynton R. Nauman were all elected as directors of the Company for the coming year and Davidson & Company LLP were re-appointed as auditors of the Company for the ensuing year. Shareholders also approved: (i) the continuation of the Company’s stock option plan; (ii) approved, on a non-binding advisory basis, the compensation of the Company’s named executive officers as disclosed in the Proxy Statement pursuant to the executive compensation disclosure rules of the United States Securities and Exchange Commission (the “SEC”); and (iii) approved, on a non-binding advisory basis, seeking stockholder advisory votes on executive compensation on an annual basis.

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

On behalf of the Board of Directors:

Joseph Mullin

President & CEO

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

345 Crown Point Circle, Suite 600

Grass Valley, CA, USA 95945

T: 530.433.0188

info@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Rise Gold Provides Corporate Update

(Show News Item)

October 30, 2024 – Grass Valley, California – Rise Gold Corp. (CSE: RISE, OTCQX: RYES) (the “Corporation”) announces that directors John Proust, Murray Flanigan and Benjamin Mossman have resigned from the Corporation’s Board of Directors with effect today. Mr. Mossman will continue to provide advisory services to the Corporation.

The Corporation thanks them for their service and wishes them well in their other endeavours.

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

On behalf of the Board of Directors:

Joseph Mullin

President & CEO

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

345 Crown Point Circle, Suite 600

Grass Valley, CA, USA 95945

T: 530.433.0188

info@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Rise Gold Closes US$500k in Debt Financing

(Show News Item)

October 10, 2024 – Grass Valley, California – Rise Gold Corp. (CSE: RISE, OTCQX: RYES) (the “Company”) announces that it has finalized the secured loan agreement with Myrmikan Gold Fund, LLC (the “Lender”) for a US$500,000 loan (the “Loan”) as previously announced in its October 2, 2024 news release. The Loan has a term of 4 years and an annual interest rate of 15%. Interest will accrue and be payable along with the principal upon maturity. The Lender will be issued 2,882,514 share purchase warrants (the “Warrants”) as additional consideration for advancing the Loan. Each warrant entitles the holder to acquire one share of the Company at an exercise price of US$0.1735 for a period of four (4) years from the date of issuance. The Loan may be repaid prior to the maturity date, in whole or in part, provided that all accrued interest is paid. The Loan will be secured against the assets of the Company and its subsidiary and will be used for the Company’s working capital. Daniel Oliver Jr., a director of the Company, is the managing member of the Lender. Mr. Oliver disclosed his interest in the transaction and abstained from voting on the resolution approving the Loan, which was unanimously approved by the remaining directors. The Warrants and any shares acquired upon exercise of the Warrants will be subject to statutory hold periods in accordance with applicable United States and Canadian securities laws.

To the extent that the participation of Mr. Oliver in the transaction constitutes a “related party transaction” under Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101”), the Company is relying on exemptions from the formal valuation requirements of section 5.4 of MI 61-101 and minority shareholder approval requirements of section 5.6 of MI 61-101. As the fair market value of the related party’s participation is not more than 25% of Rise Gold’s market capitalization, the related party transaction is exempt from the formal valuation requirements pursuant to subsection 5.5(a) of MI 61-101 and from the minority approval requirements pursuant to subsection 5.7(1)(a) of MI 61-101.

The securities described in this news release have not been registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws and may not be offered or sold absent registration or compliance with an applicable exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws.

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company’s principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

On behalf of the Board of Directors:

Joseph Mullin

President and CEO

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

345 Crown Point Circle, Suite 600

Grass Valley, California, USA 95945

|T: 530.433.0188

info@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words or statements that certain events or conditions “may” or “will” occur.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks, uncertainties and assumptions related to certain factors including, without limitation, obtaining all necessary approvals, meeting expenditure and financing requirements, compliance with environmental regulations, title matters, operating hazards, metal prices, political and economic factors, competitive factors, general economic conditions, relationships with vendors and strategic partners, governmental regulation and supervision, seasonality, technological change, industry practices, and one-time events that may cause actual results, performance or developments to differ materially from those contained in the forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements and information contained in this release. Rise undertakes no obligation to update forward-looking statements or information except as required by law.

Rise Gold Negotiates US$500k in Debt Financing

(Show News Item)